Three businesses to receive tax incentives

Published 8:34 am Thursday, October 12, 2017

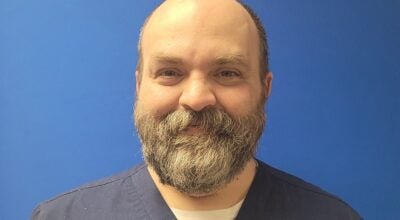

- File photo by Ben Kleppinger Denyo Manufacturing in Danville.

Three businesses are well on their way to receiving tax incentives from Danville and Boyle County, after the plans were reviewed again during this week’s meetings of the Danville City Commission and the Boyle County Fiscal Court.

The Danville City Commission had second reading on an incentive Monday night for Denyo Manufacturing Corporation, granted under the Kentucky Business Investment Act. The company is in the process of expanding its operations to include “creation and continuous maintenance of at least 10 full-time jobs, but no more than 90 new full-time jobs.”

The vote passed unanimously.

Denyo Manufacturing expects to employ 66 new people in its first year of expansion, with a total payroll of more than $2 million; that’s projected to grow to 90 new people and almost $2.79 million in payroll by year seven.

The tax incentives from the two governing bodies work together — Danville provides a .72 percent reimbursement and Boyle County provides a .28 reimbursement, together equaling a one percent reimbursement.

A “job development incentive” sheet from the Danville-Boyle County Economic Development Partnership shows that Denyo could receive up to $181,979.86 in incentives from Danville and up to $70,769.94 in incentives from Boyle County, for a total of up to $252,749.80 in incentives.

The Boyle County Fiscal Court had second readings on two other incentives at their Tuesday meeting — Adkev, Inc., and Wilderness Trace. The Danville City Commission held second readings on those incentives on Sept. 25.

Adkev is expected to employ 25 people with a total payroll of about $972,000 in its first year of operation, currently slated for 2019. That number is expected to grow to 40 employees with a payroll of more than $1.4 million in year two, and continue growing to reach 70 employees with a payroll of about $2.56 million by year five.

Wilderness Trail is expected to employ 10 new people with a total payroll of $442,000 in year one; swelling to 15 new people with a payroll of $663,000 in year five.

In total, the three businesses are expected to be given incentives up to $662,544.22. The three would amount to $6 million annually in new salaries, and the city and county would collect about $159,000 in payroll taxes on that amount, about $60,000 of which would be reimbursed to the companies while the incentives are active.

If the companies don’t meet their targets, they will not receive the full incentive amounts.

SO YOU KNOW

When companies are given payroll tax incentives, payroll taxes are still taken out of employees’ paychecks at the normal rate. The business then receives a reimbursement from the government for a portion of those taxes.