City commission doing what is necessary to cover $30M-$40M in needs

Published 8:47 am Tuesday, June 20, 2017

By MIKE PERROS

Danville Mayor

On Feb. 3, the Danville City Commission and staff held a six-hour retreat and planning session. This was the first time in recent memory, if ever, that the city staff and commissioners took a hard look into the foreseeable future.

From this retreat, we identified future needs and expenses from top to bottom. Issues such as maintenance, upgrades, replacement of equipment, roads, sidewalks, streets, cemeteries, storm-water projects, water issues such as line extension, lift station upgrades, water storage tank, cost to condemn/tear down unsafe properties … the list goes on.

We identified hard needs, not wants, in the range of $30 million-$40 million. This list is available to anyone to review. In fact we welcome it.

The city has essentially five ways to pay for providing services or making improvements. They are:

alcohol regulatory fees;

municipal insurance premium taxes;

property taxes;

net profits taxes; and

occupational license fees (payroll taxes).

Of these five, the largest is the occupational license fee, which produces 60 percent of the total annual city revenue.

With this large list of needs, not wants, coupled with the cities limited income streams, as previously mentioned, this commission and staff have endeavored to weigh all pros and cons to the proposed budget. This commission has looked at many ways to squeeze the expense side of our needs. The areas are limited, unless we want to cut city services, which we feel is a step in the wrong direction.

Clearly, of our income sources, the one that can impact the financial health of city government and the City of Danville as a whole is the payroll tax. In other words, it’s in all our best interests to grow our local economy by adding jobs. In a proactive move to address this need, for the past two budget cycles, the city has allocated funds to implement the services of a nationally recognized economic development analyst.

In fact, the city paid about 80 percent of the total cost, as it is clear to us we have but two choices going forward: 1) increase revenue from creating an increased number of jobs; or 2) raise taxes.

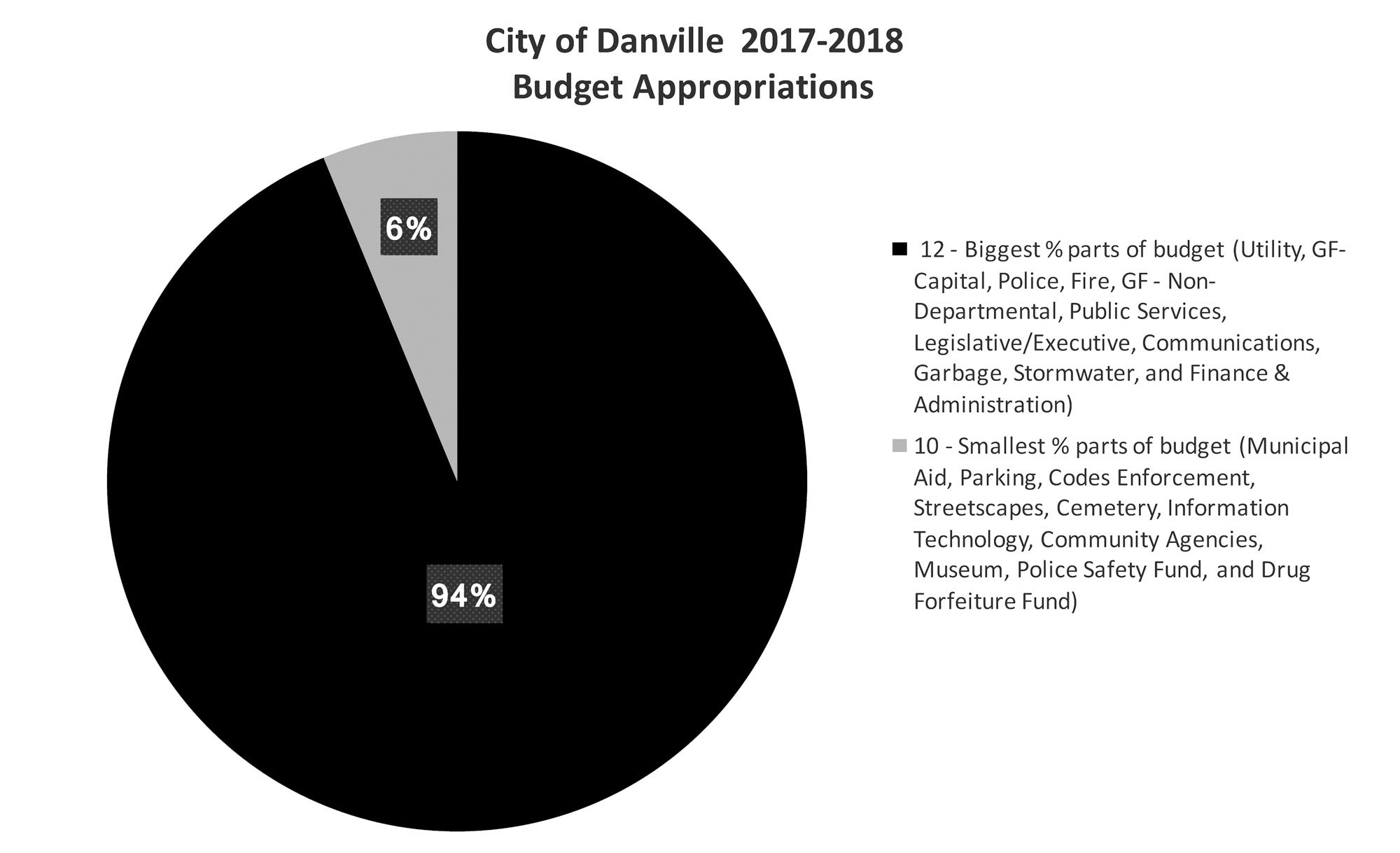

From the chart accompanying this column, you can quickly see that the vast majority of the city’s expenditures are of a “fixed cost” nature. The balance, even if cut by 50 percent, would just barely cover the projected future cost increases. This situation would be different if we didn’t need, not want, a safe fire station and a new ladder truck to replace the current 25-year-old ladder truck.

But as they say, “it is what it is.” These expenditures are central to the main purpose of government and essential to providing a safe and livable community for businesses to operate, including real estate businesses. We did incrementally raise taxes two years ago and now find it necessary to do so again to meet our community’s identified needs.

I mentioned a moment ago that these are two ways to grow our revenue: raise taxes or add jobs. This is precisely why your city led the effort to hire a nationally recognized firm, RKG Associates, to assist us in re-focusing our economic development efforts. I am confident this expenditure of funds, time and manpower will pave a new path of prosperity for Danville and Boyle County.

Unfortunately, to achieve that new prosperity will take several years, not months. For us, as city commissioners and staff, the time of need for our citizens is now.

But, let me be clear: At some point, a continuance of raising taxes begins to defeat our purpose, which is to grow the economy. The answer, looking forward, is the same answer when you look backwards: increase jobs — not just any jobs, but high-quality, high-income jobs.

The challenge is clear. Thanks to RKG, our path is clear. Our focus in the coming years on economic development will be sharp. We simply must have more business in our communities.

Mike Perros is the mayor of Danville.